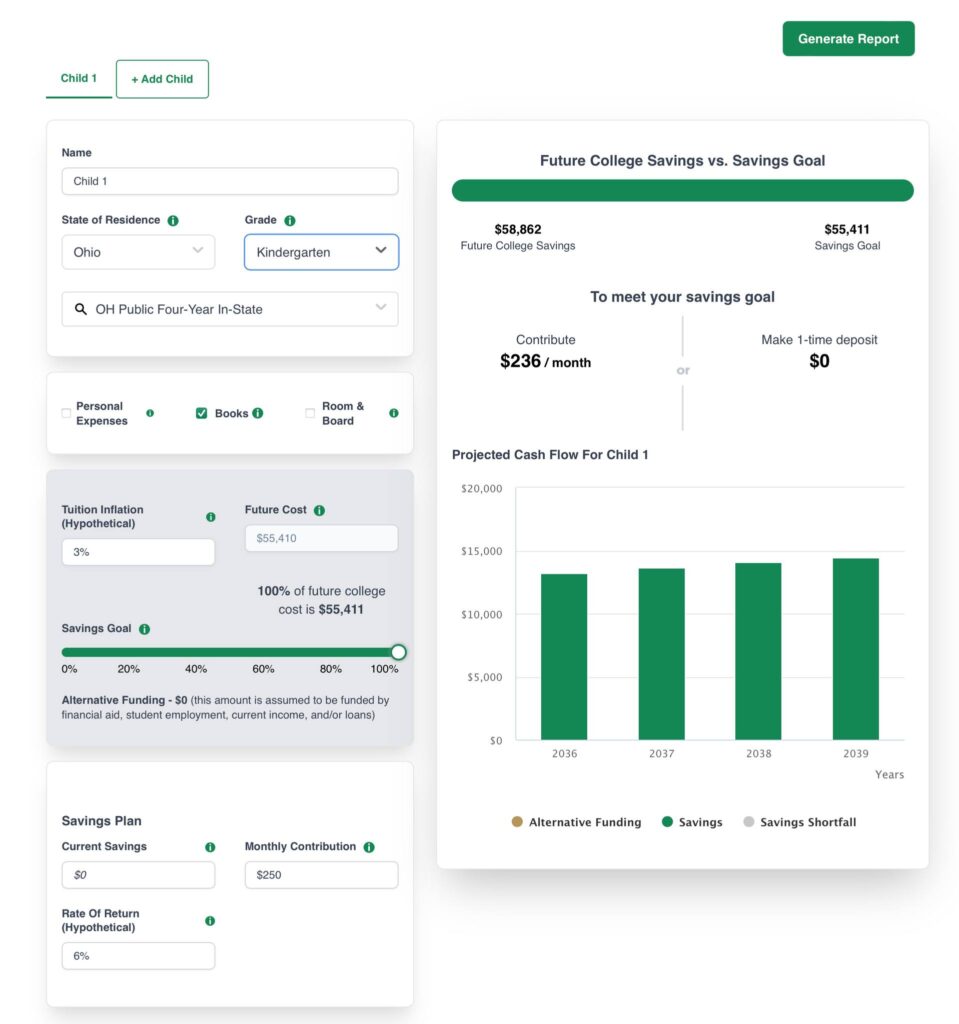

It’s never too late to start planning for your child’s college costs. 529 plans allow for parents, grandparents, and other family members to contribute to the students college future. Whether you start a 529 plan when the student is born, when they start kindergarten, or in high school, every little bit helps to offset the cost by setting up your student’s financial future. Saving early and picking the right school and program can save you and your students thousands. Use the estimator below to compare private, public, and local options that don’t require room and board.

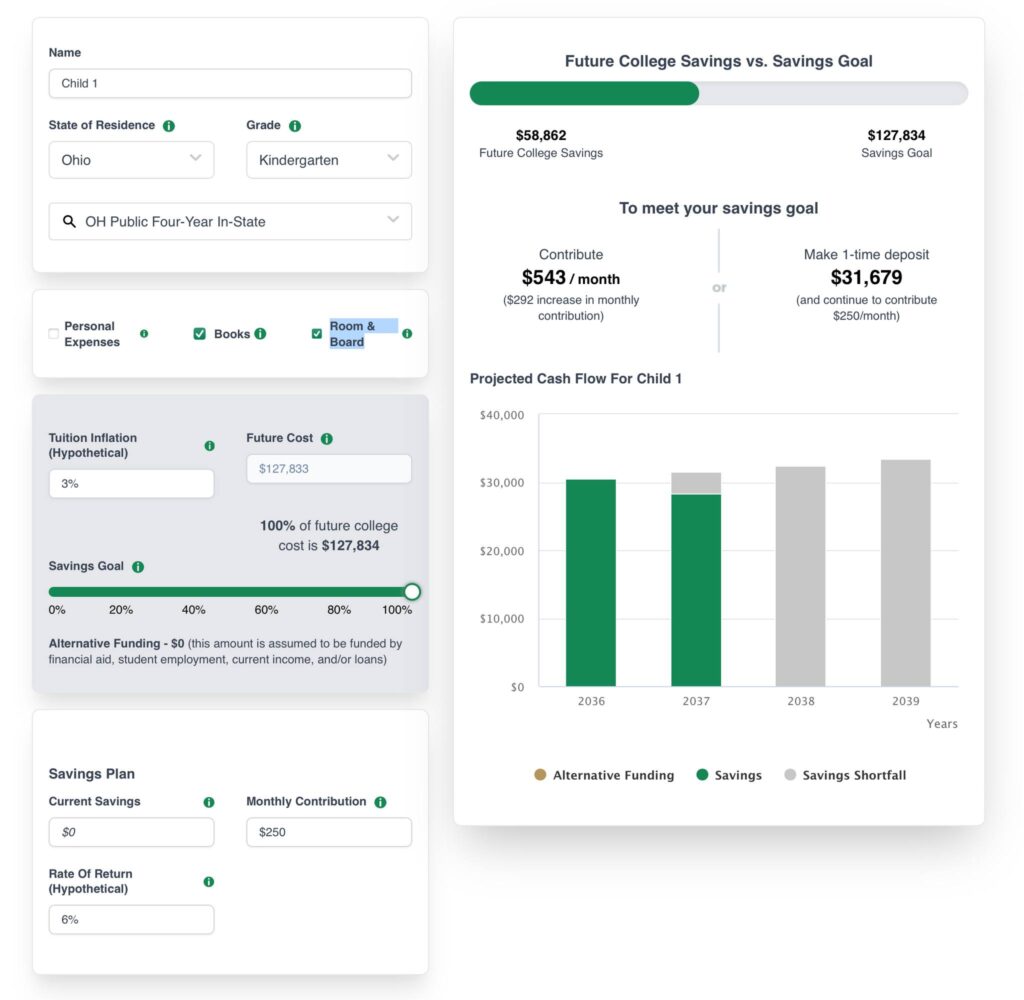

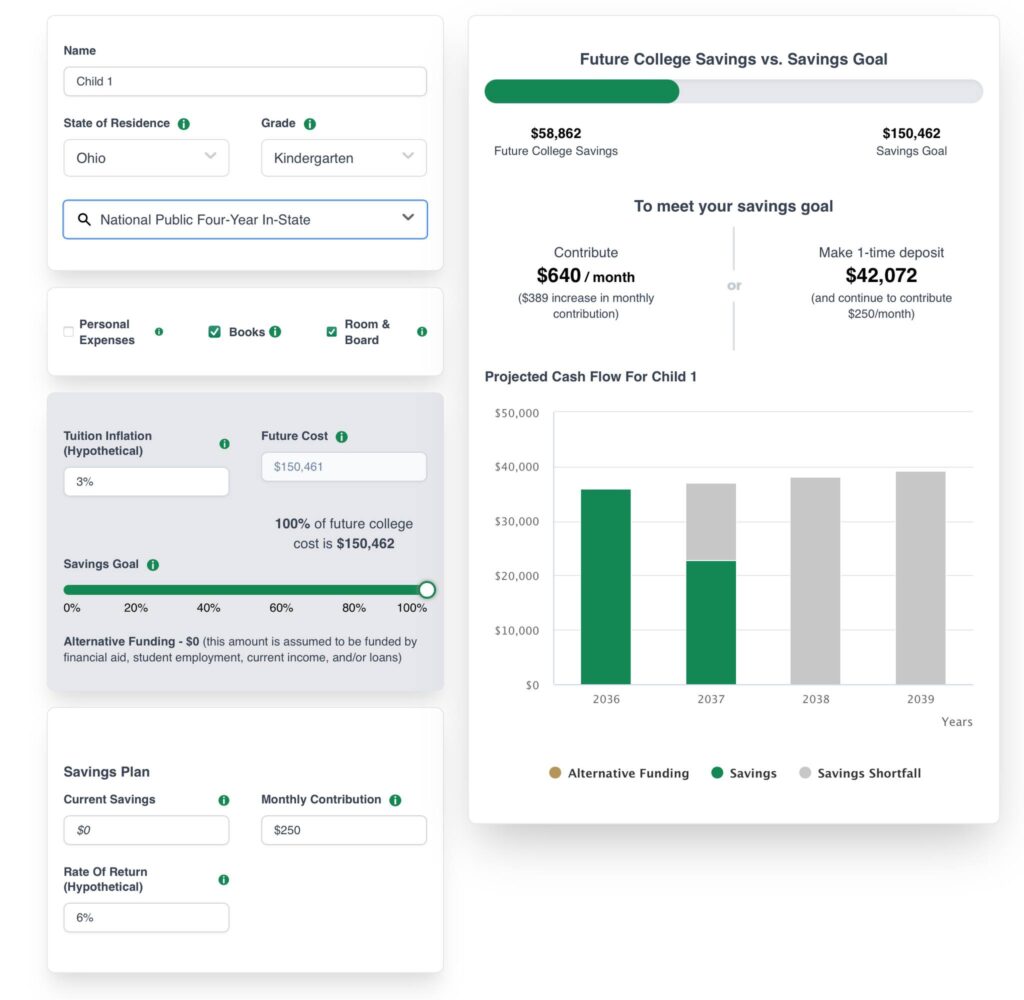

Each example below is based on saving $250 a month when the student enters kindergarten. Amounts are based on a 6% return. If the funds were set aside in a non-interest-bearing bank account, only $39,000 would be available by the student’s freshman year in college.

Please note the examples below are estimates. For more details about opening a college fund, please contact a financial planner.